Foodservice trends Restaurants resist headwinds

Foodservice trends Restaurants resist headwinds. The foodservice segment faced a turbulent first half of the year as significant challenges from rising costs to uncertainty regarding the impact of tariffs and cautious consumer sentiment pressured restaurants. In this environment restaurant operators heightened their focus on value and convenience, often introducing limited-time promotions and highlighting the value of chicken to attract consumers. Many Food Restaurants Provide Burger deal, but Wendy’s Burger Deals Menu is one of the best Deal all from other restaurants.

Analyzing the economics

- Restaurant transactions declined 7% year-over-year during the first quarter of 2025, the worst such decline since the first quarter of 2021, according to Rabo Research’s Foodservice Quarterly report.

- “We saw the bottom or the near-term bottom in Q1 because sentiment hit its lowest level since the pandemic and the lowest level since the 80s prior to that,” said Tom Bailey, Rabobank’s senior analyst for consumer foods. “Consumer sentiment is such a big driver of the consumer eating out.”

- Rising costs have played a significant role in the challenges the foodservice industry has faced recently, said Chad Moutray, chief economist with the National Restaurant Association.

- “We’ve seen overall wages increase 35% since the pandemic and food costs go up around 37%,” Moutray said. “In a world where operators operate on very thin margins, these pressures have been intense.”

- Moutray said there was overall weakness in sales in January and February due to the weather and reaction to policy change, but there was a rebound in activity in March and April, and the data for May and June are a bit more mixed.

- Additionally, the overall affordability of eating out remains an issue.

- “Post-pandemic after housing, foodservice has seen the second largest increase in cost, up 32%,” Bailey said. “It’s nearly five times more expensive now to eat out of the house than it is to eat at home, so that’s something the food system really has to try to solve.”

- Looking ahead, 33% of restaurant operators expect their sales volume in six months to be higher than it was during the same period of the previous year while 27% of operators believe their sales will be lower, and 40% of operators anticipate flat sales, according to the National Restaurant Association’s May 2025 Restaurant Performance Index.

- “Across foodservice, we’re not seeing a tremendous amount of growth,” said Evert Gruyaert, US restaurants and foodservice leader with Deloitte. “It really is, in essence, now a share game. It’s about stealing consumers from your competition, and restaurants and foodservice companies are very much competing with retail right now.”

Sizing up value

“You definitely have the trend of more wellness focused, health-conscious consumers that lean more towards leaner protein like chicken and turkey,” Gruyaert said. “Because it is so hot and consumers are so interested in chicken sandwiches and strips, you see the brands are using proteins to fight these value wars.”

Christopher Kempinski, president, chief executive officer and chairman of the board for McDonald’s, said QSR industry traffic from low-income consumers was down nearly double digits during the first quarter compared with the same period of the previous year, and traffic from middle-income consumers fell just as much.

- Popeyes introduced a chicken wrap for a limited time, and Sonic launched two new crispy chicken wraps. Additionally, Taco Bell is offering crispy chicken tacos and burritos for a limited time, while Chipotle launched a limited time offer of chipotle honey chicken.

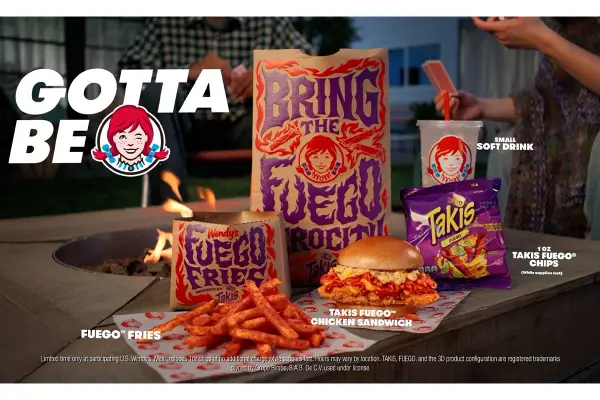

- To that end, McDonald’s recently reintroduced its Snack Wrap, which was taken off the menu back in 2016. The product is now offered on a permanent basis in spicy and ranch flavors. Other menu innovations in recent months include Wendy’s partnership with Grupo Bimbo’s Takis brand for the Takis Fuego Chicken Sandwich, and CKE Restaurants Holdings Inc. brand Hardee’s introduction of a barbecue pulled pork fresco sandwich, both as limited time offers.

- Popeyes introduced a chicken wrap for a limited time, and Sonic launched two new crispy chicken wraps. Additionally, Taco Bell is offering crispy chicken tacos and burritos for a limited time, while Chipotle launched a limited time offer of chipotle honey chicken.

- “Chicken-focused concepts grew faster than burger-focused concepts last year, but burger chains are still bigger from an overall sales volume perspective,” said Kevin Schimpf, senior director of industry research, Technomic.

- Total chicken chain sales increased 9% in 2024, making it the second-fastest-growing category behind beverage/snack chains, according Schimpf and the “Top 500 Chain Restaurant Report” for 2025 from Technomic. The report also found Raising Cane’s and Wingstop were up more than 30% last year.

- Gruyter said many foodservice companies are working on sauces, spices, and marinades to refresh menus while personalization with beverage flavors has also become important.

- Asian dishes like Korean bingo, kimchi and bibimbap, and Vietnamese cuisine like pho, Bahn mi, and mi Quang are all popular and represent opportunities for growth, according to the National Restaurant Association’s “What’s Hot 2025” report.

- Customization and value-added promotions are ways restaurants are attracting consumers, Bailey said. For example, 7Brew’s success is largely driven by customization and relative affordability. He also said Chili’s 3 for Me deal is an example of a successful value-added promotion along with Denny’s offer of 4 Slams for under $10.

- Value is increasingly important to consumers, and 47% of operators reported plans to add new discounts, deals, or value promotions this year, according to the National Restaurant Association’s State of the Industry 2025 report.

- “Value is the whole package, it’s not just price,” Moutray said. “It is what you can deliver in terms of overall experience, in terms of food quality.”

- “Taste is still paramount for consumer’s purchasing decisions, so when looking at deals this should always be the top priority for restaurants,” Bailey said.

Increasing efficiency

Restaurants are seeing the possibilities for AI with 82% of restaurant executives saying they plan to increase investments in AI technologies in the next fiscal year, according to Deloitte’s “How AI is Revolutionizing Restaurants” report. Of those operators, 60% plan to use AI to improve customer experience, 36% use the technology to advance operations, and 31% of restaurants use it to boost loyalty programs. The report also found 52% of brands and 84% of operators believe AI has a significant impact on customer experience.

- In addition to new products and value-added promotions, restaurants are looking to leverage various technologies to drive efficiency in both the front-of-house and back-of-house, Gruyaert said. In the front-of-house this includes expanded use of kiosks and apps for ordering. In the back-of-house, the use of robotics for meal preparation and AI-driven inventory management is growing.

- Chipotle is implementing more robotic technology like its autocade that can cut, core, and peel an avocado in 26 seconds and its digital makeline that builds and fills bowl orders.

- “To unlock AI’s potential, leaders will likely need to balance innovation and operational discipline, strengthen governance, and address capability gaps to help optimize operations, boost margins and future-proof their business — in both the front and back of house,” Gruyter said.

- Working closely with suppliers is another way to increase efficiency as suppliers might be able to provide products that require less in-house labor, Gruyaert said. For example, a poultry supplier could begin taking care of preparation steps like breading chicken.

- “Suppliers are going from being a supplier to being a strategic partner with restaurants,” Gruyter said.

Future avenues for growth Foodservice trends Restaurants resist headwinds

Strengthening collaboration between the animal protein sector and foodservice companies could benefit both industries as longer-term and direct relationships with restaurants could give animal protein companies a more stable business environment to grow their supply chain, according to Rabo Research. On the other hand, restaurants could benefit from these agreements through the development of a dependable supply source.

- “There is a huge tie between technology and the loyalty programs and the drive toward increasing drive-through, takeout, and delivery that is something particularly younger generations find to be an essential part of their lifestyle,” Moutray said.

- Off-premises dining options, whether takeout, drive-through, or delivery, are continuing to grow as 30% of customer traffic at full-service restaurants was off-premises in 2024, up from 19% in 2019, according to Circata/CREST data and the National Restaurant Association’s “Off-Premises Restaurant Trends 2025” report. The limited-service segment saw 83% of its traffic come from off-premises in 2024, up from 76% in 2019.

- Restaurants might also look at changing their consumer marketing to focus on a more segmented and personalized approach, Deloitte said in its “Future of Restaurants and Foodservice” report. Advancements in technology will continue to play a critical role in growth, and companies will need to cultivate multiple channels for ordering and receiving food.

- As the foodservice sector looks to increase traffic after a challenging period, increasing focus on value and convenience will meet consumer needs while leaning into technology will help create efficiency.